How does the ownership structure in electricity markets affect their ability to deliver competitive electricity prices?

Based on research by Natalia Fabra and Gerard Llobet

In 2019, the Financial Times published an article entitled “Europe’s utilities battle for survival in changing market place,” highlighting a significant shift in the corporate strategies of European electricity companies. In order to thrive in an evolving market, traditional utility companies were choosing to specialize in renewable energy, away from fossil fuels.

Well-established energy giants like E.ON and RWE in Germany or Scottish Power in the UK exemplify this trend by strategically selling off their fossil fuel divisions and concentrating their investment in clean-energy sources. Concurrently, new entrants, including investment funds and major oil companies facing pressure to invest in low-carbon assets, have entered the power sector with a strong focus on renewable energy.

These strategic shifts are reshaping the power sector from one characterized by companies that own diverse technological portfolios to a landscape that involves some firms specialized in renewable energy in direct competition with others that mainly operate fossil-fuel plants. In our recent paper, “Fossil Fuels and Renewable Energy: Mix or Match?”, we focus on the competitive effects of this shift, which could help explain firms’ incentives to specialize.

We build a stylized model of wholesale electricity markets in which we compare the strategic interaction between specialized firms, as opposed to diversified firms. More specifically, firms are specialized when they own a single technology (renewables or fossil-fueled power plants); they are diversified when they own both technologies. We keep the existing number of renewable and fossil-fueled power plants fixed, and the relative capacity of the competing firms equal, so as not to introduce differences across scenarios other than the ownership structure. A key ingredient of our model is that the capacity of the renewable plants is subject to shocks, which are privately known by their owners as in Fabra and Llobet (2023a), reflecting changes in local weather conditions that affect the actual availability of the plants.

Our findings reveal a fundamental trade-off between the specialized and diversified ownership structures during the early stages of the Energy Transition, when fossil-fuels dominate. Specialization always leads to higher prices but also higher productive efficiency compared to diversification. The reason is that firms specializing in renewable or fossil fuels do not compete head-to-head. The renewable firm can afford to offer low prices, knowing that the thermal producer will set the highest admissible market price in order to maximize its profits over the residual demand. Because the renewable firm is dispatched first, the specialized ownership structure leads to productive efficiency despite giving rise to higher prices.

Diversification, in contrast, fosters within-technology competition by placing price-setting plants in the hands of competing firms. This force depresses market prices. However, since firms own a portfolio of technologies, diversification entices them to escape competition by raising the bid of their renewable production in order to jack up the market price. This strategy may jeopardize the dispatch of some low-cost renewable production, which engenders productive inefficiency.

However, during the later stages of the Energy Transition, once renewable energy investments have outgrown existing fossil-fuel capacity, this trade-off disappears, as the specialized ownership can lead to substantial efficiency losses, making the diversified ownership structure socially preferable both in terms of lower prices and productive efficiency.

In line with previous analyses, we find that increasing renewable-energy capacity depresses market prices. However, a novelty of our analysis is to show that this price-depressing effect is stronger under diversification than under specialization. Interestingly, renewable energy is pro-competitive under diversification even when it is not a price-setting technology. The reason is that renewable energy reduces the residual demand left for thermal plants to cover. Hence, if they do not outbid the rival, the output left for the high-bidding thermal plant is smaller when renewable energies are more abundant, which induces them to bid aggressively. This effect is absent under specialization as thermal plants are in the hands of the same company, with no need to compete for market share.

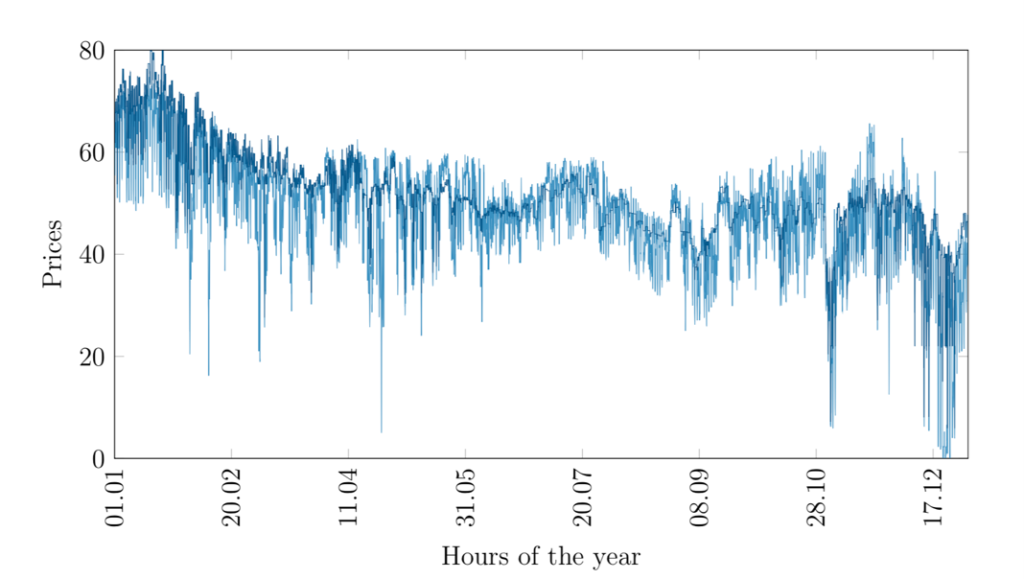

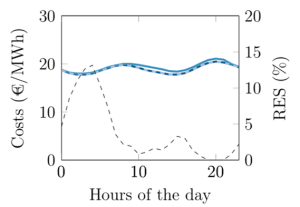

We illustrate our theoretical predictions with highly detailed simulations of the Spanish electricity market. We consider two scenarios with low and high renewable energy penetration in order to uncover the differential effects of ownership structures along the Energy Transition. Simulations are conducted at the hourly level during a year, considering the hourly changes in demand and supply conditions (mainly, the availability of renewable energy). As shown in Figure 1, the model does a good job in replicating 2019 actual market prices when fed with the prevailing corporate structure and market conditions.

Figure 1: Real and simulated hourly electricity prices

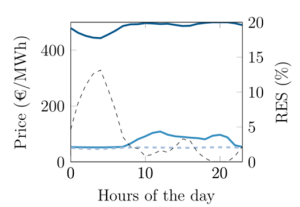

We perform simulations with specialized and diversified ownership structures, mimicking our theoretical work. In the first case, we allocate all the thermal capacity (gas and coal) to one firm and all the renewable capacity to the other. In the second, we assume that the two strategic firms have equal shares of all thermal and renewable power plants.

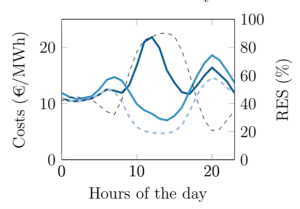

Figure 2 shows the average hourly equilibrium prices along the day in the scenario with low renewable and high renewable production when firms are diversified (light blue) or specialized (dark blue) against the competitive benchmark (dashed line). When renewable penetration is low (left panel), the specialized structure generates prices at or close to the price cap (500€/MWh), while the diversified structure results in almost competitive prices. Price differences become narrower when renewable penetration is high (right panel), but prices under specialization remain higher than under diversification.

Figure 2: Average prices, ownership structures, and renewable energy penetration

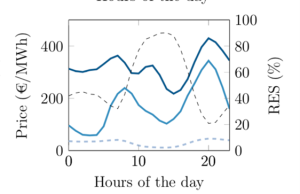

Figure 3 shows the simulated results regarding hourly equilibrium costs. When renewable penetration is low (left panel), generation costs are very close to the efficient benchmark under both ownership structures. In contrast, when renewable penetration is high (right panel), renewable capacity withholding distorts productive efficiency. The effect is more pronounced under the specialized ownership structure at the mid-hours of the day when solar production is higher.

Figure 3: Generation costs, ownership structures, and renewable energy penetration

In sum, our analysis indicates that the ability of electricity markets to pass the lower costs of renewable energies to consumers very much depends on the corporate structure. This question is of utmost importance given that electricity prices influence the incentives for electrification and, with it, the success of the Energy Transition. In that respect, our model suggests that the ongoing trend toward specialization by European electricity firms could be consistent with an attempt to mitigate wholesale market competition. Whether this was actually the case requires further empirical investigation.

Further Reading:

Fabra, N. and Llobet, G. (2023a) “Auctions with Privately Known Capacities,” The Economic Journal, 133, pp. 1106–1146, 2023.

Fabra, N. and Llobet, G. (2023b) “Fossil Fuels and Renewable Energy: Mix or Match?”, EEL Working Paper 118.

About the authors:

Natalia Fabra is an industrial economist working in the field of Energy and Environmental Economics. She is Professor of Economics at Carlos III University.

http://nfabra.uc3m.es/

Gerard Llobet is an industrial economist working in the field of Energy and Environmental Economics, Innovation, Intellectual Property, Antitrust and Competition Policy. He is an Associate Professor at Cemfi.

https://www.cemfi.es/people/faculty/profile.asp?u=llobet