Spain is the only country where households pay real-time prices for electricity. Is this pricing policy efficient and fair?

Based on research by Michael Cahana, Natallia Fabra, Mar Reguant, David Rapson and Jingyuan Wang

If you are reading this post from Spain, it is likely that you will be paying real-time prices for your electricity bill, whether you are aware of it or not. This means that if you turn on the lights now, you will be paying a price that reflects the current demand and supply conditions in the wholesale electricity market, and which will likely change an hour from now. Indeed, Spain is the only country in the world where, by default, households are subject to real-time prices for retail electricity. Even though they can opt out to the time-invariant prices offered by the unregulated retailers, many households remain under the real-time pricing regime.

On the efficiency of real-time pricing

For economists, this is generally viewed as good policy. Dynamic pricing creates efficient incentives for energy conservation and for demand shifting across time. If a consumer derives less utility from consuming one additional unit of electricity than the costs of producing it, she should optimally not consume it. Otherwise, she could shift her consumption to a time when production costs are lower, possibly because of lower overall demand, or because of more availability of renewable energy. However, she will only make these efficient decisions if she faces electricity prices that reflect the changing marginal costs of her consumption. Therefore, facing consumers with real-time prices is a necessary condition for efficient consumption. The benefits from this regime are expected to become even stronger with the widespread deployment of renewable energy sources, which are expected to increase cost and price differences over time.

In practice, is real-time pricing efficient?

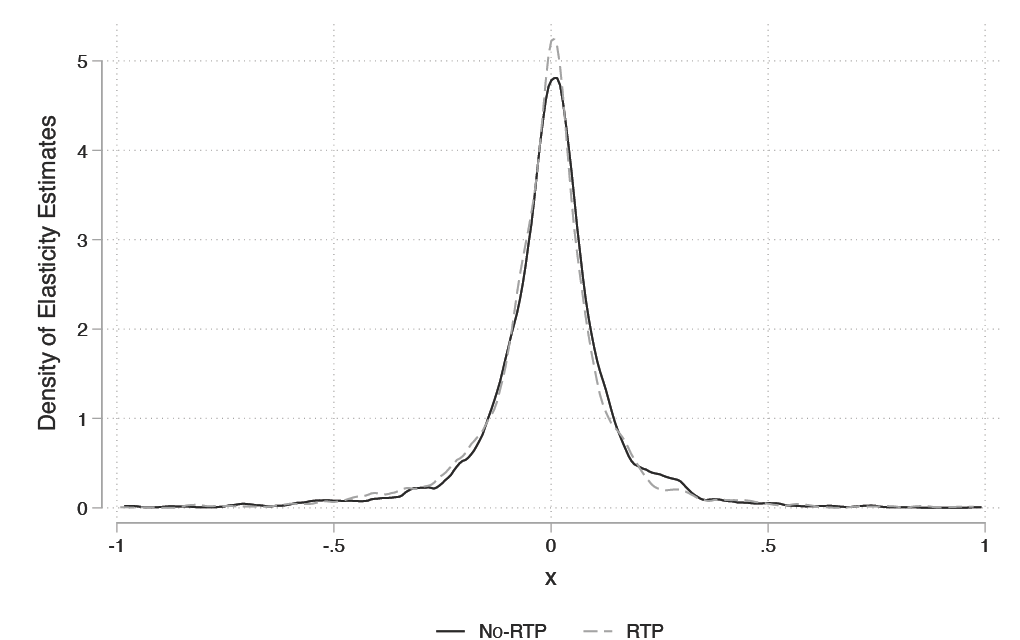

Despite these well-known benefits, policymakers have been reluctant to implement dynamic pricing beyond industrial consumers. Why is this the case? In our recent research (Fabra et al., 2021), we put forward two potential reasons. The first one has to do with the true social and private benefits of real-time pricing, which for residential consumers are expected to be smaller in practice than in theory. The key reason is that households’ elasticity to real-time prices is small. In other words, they rarely turn off the lights when electricity prices go up and they rarely move their laundry time from high-price to low-price hours, for example. At least this is what our research suggests. We have analyzed smart-meter electricity consumption data from over two million Spanish households between 2016 and 2017, when the real-time pricing policy was already in place. Our main results are depicted in Figure 1, which shows that the distribution of the estimated household-level elasticities is centered around zero. The distributions for households on time-invariant prices versus those on real-time prices look very similar.

There are several potential explanations for this finding: consumers may not be aware of real-time prices; it might be too costly for them to acquire the information; and even when they are aware and informed, the benefits from changing their consumption decisions often exceed the costs. This is especially true when price differences throughout the day are small, as was the case for Spain during our sample period.

Figure 1: Distribution of the estimated household-level elasticities to real-time prices (RTP) and time-invariant prices (No-RTP)

Figure 1: Distribution of the estimated household-level elasticities to real-time prices (RTP) and time-invariant prices (No-RTP)

Is real-time pricing unfair?

Another concern that might explain why real-timing is not more broadly adopted is the fear that low-income households will be hit harder than others, particularly in countries with large shares of energy-poor households. We do not need to search far. In Europe, it is estimated that there are between 50 and 125 million people facing energy poverty, and Spain is no exception.

Using the same electricity consumption data as in the previous study, we have also analyzed the distributional implications of the adoption of real-time pricing in Spain (Cahana et al., 2022). In particular, we have quantified how bills change when switching from time-invariant to real-time prices, and have studied how these changes correlate to socio-demographics. Rather than using zip code level income data, we have developed a novel method that leverages the hourly smart-meter consumption data to estimate households’ income. We demonstrate that this is a critical step, as most of the distributional implications can attributed to income heterogeneity within each zip code.

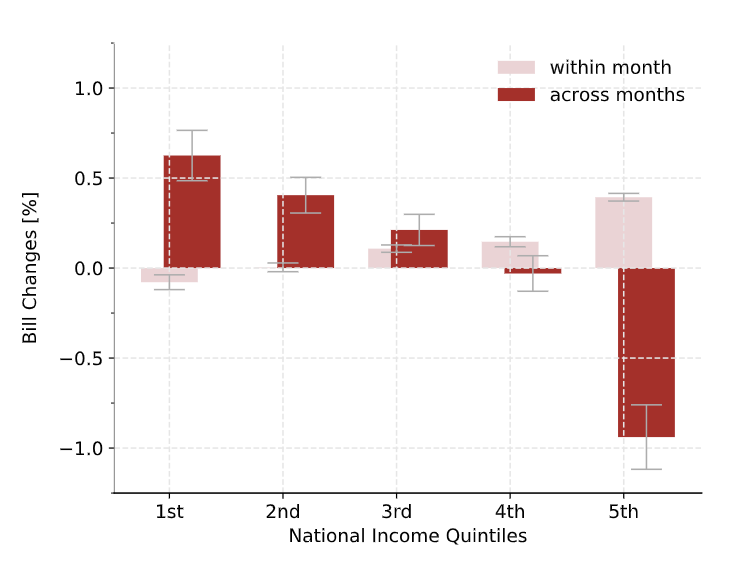

We have found that real-time pricing is slightly regressive compared to an annual flat price, a conclusion that can be traced back to two main effects: the “across months” and the “within month” price effects. First, the switch from annual to monthly prices hurts low-income households, who tend to have more electric heating, as they lose the price insurance provided by time-invariant prices during winter, when prices tend to be higher and more volatile. However, the second effect moves in the opposite direction, as a switch from monthly to hourly prices hurts the high-income households, who consume disproportionately more at peak times when real-time prices are higher. The former effect dominates, given that price differences are wider across months than within months (and within days) in our sample.

Figure 2 illustrates these two effects by plotting the bill changes when moving from an annual time-invariant price to monthly prices (pink bars) and from monthly prices to real-time pricing (red bars), for the five national income quintiles (using our estimated household-level incomes). As the figure shows, the across month effect implies that the first quantiles (i.e., the lower income households) face higher bills under real-time prices, while the bills of the higher quantiles go down. The within month effect hurts the higher quantiles, but this effect is relatively small compared to the bill savings due to the across month effect.

Figure 2: Bill changes from time-invariant prices to real-time prices per income quintile

So, real-time prices…yes or no?

Our studies reveal that Spanish households did not change their electricity consumption in response to the switch to real-time prices, yet the policy gave rise to a slight regressive effect. In any event, since prices were relatively stable during our sample period, the overall effects were small. The take-away is that real-time pricing did not lead to concerning levels of redistribution. However, patterns could change if price levels and price volatility go up, as it has been the case over recent months. If high-income households are the most capable to respond to price spikes and to benefit from price volatility – for example, by investing in batteries, solar panels or electric vehicles – the regressive impacts of the policy could potentially grow.

These findings are not general condemnations of real-time pricing as a useful policy tool, but rather inform about necessary conditions for it to be successful. First, it might be required to put in place public campaigns to increase awareness, and to deploy technology for automatic demand adjustments. This, together with the increasing price differences that will likely arise between hours with scarce and abundant renewables, would help induce measurable changes in consumption patterns in ways that increase overall efficiency. Furthermore, it is important to mitigate the potentially adverse distributional implications of real-time pricing, at least in contexts in which low-income households rely more on electric heating during the high-priced winter months, as is the case in Spain. One option would be to demean retail prices with the annual average, while still maintaining the hourly price signal. This could be achieved by reducing the volumetric charges (that are added to the real-time prices to cover the network costs) during the winter while raising them during the summer. Another option is to put in place policies to mitigate energy poverty; for instance, through consumption subsidies or investments in energy efficiency and solar panels in low-income households, which could be financed through windfall taxes on the inframarginal technologies, as the European Commission is currently proposing.

There is no doubt that a successful energy transition will require smart technologies just as much as smart pricing policies.

Further Reading

- Fabra, N., D. Rapson, M. Reguant, and J. Wang (2021) “Estimating the Elasticity to Real Time Pricing: Evidence from the Spanish Electricity Market“, American Economic Association Papers & Proceedings, 111, 425-29.

- Cahana, M., Fabra, N., M. Reguant, and J. Wang (2022) “The Distributional Impacts of Real-Time Pricing”

About the authors

Michael Cahana is a data scientist working at Quora.

Natalia Fabra is an industrial economist working in the field of Energy and Environmental Economics. She is Professor of Economics at Carlos III University.

Mar Reguant is an industrial economist working in the field of Energy and Environmental Economics. She is an Associate Professor in Economics at Northwestern University and Research Fellow at the Barcelona School of Economics.

Jingyuan Wang is a PhD student at Northwestern University.