What is the impact of recessions on workers’ careers across age, education, and cohort groups?

By Andrés Erosa

Based on research by Andrés Erosa, Ismael Gálvez-Iniesta, Matthias Kredler.

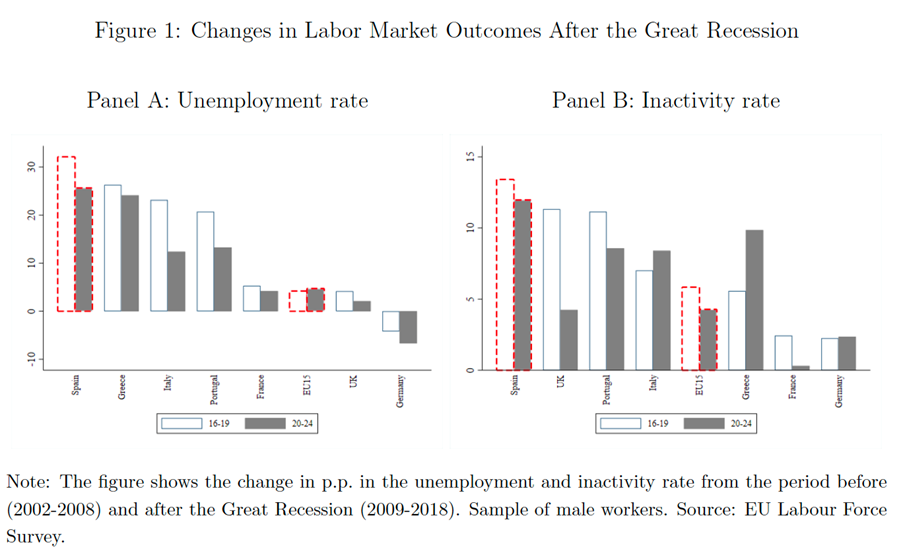

Being a young worker in Spain is hard, especially after the Great Recession (GR) in 2008. Figure 1 presents data from the European Labor Force Survey on changes in the unemployment rate of the young across European countries. While young individuals have experienced worse labor market outcomes after the Great Recession in most countries, the increase in youth unemployment has been among the largest in Spain. During 2002-2008 to 2012-2020, the mean employment rate of males in the age group 20 to 24 decreased from 60% to 35% in Spain, while it decreased from 61% to 54% in the EU-15. The negative evolution of the Spanish employment rate mirrors the increase in the youth unemployment rate, which rose from 16% to 41% between the two periods considered, making Spain the champion of European youth unemployment. Moreover, the labor market attachment of young Spanish individuals decreased strongly, with the inactivity rate among individuals aged 20 to 24 rising by about 12 pp. and experiencing the highest increase in the EU-15 countries.

The Spanish evidence suggests that macroeconomic uncertainty may have long-lasting and heterogeneous effects on employment and wages across workers. Economists and policymakers view the duality of Spanish labor market institutions as the key factor explaining the high unemployment rate in Spain, its volatility, and its variation across demographic groups (Bentolila et al., 2012; Costain et al., 2010). In ongoing research (Erosa et al. 2023), we document facts on how the Great Recession affected labor turnover in Spain and build a quantitative theory to assess the unequal long-run effects of recessions across various demographic groups. We answer the following questions: What are the long-run effects of recessions on workers’ careers? How do these effects differ across cohorts and education groups? What are the roles of skill accumulation and the duality of labor markets in Spain in amplifying the impacts of macroeconomic shocks?

Using Social Security administrative data, we document that i) young Spanish workers suffer from a high unemployment rate due to both low job-finding and high separation rates and that ii) the evolution of labor market hazards after the Great Recession has hurt the employment prospects of young individuals. In assessing the long-run effects of these changes, we specify a rich model that allows us to closely track the labor-market transitions and earnings dynamics in booms vs. recessions. Our theory builds on Heathcote, Perri, and Violante (2020), while the research methodology is similar to the one employed by Pijoan-Mas and Ríos-Rull (2014). The duality of labor market contracts in Spain motivates the assumption that workers can find two types of jobs: temporary versus permanent. Our theory allows the job-finding and job-separation rates to depend on the job type, workers’ skills, education, and the aggregate state of the economy (boom versus recessions), permitting the model to mimic the variation of hazard rates across individuals and over time. We make standard assumptions on skill growth, with higher growth when at work than without a job. Young workers in the model are more likely to be employed under temporary contracts than older workers, increasing their likelihood of facing a job separation when a recession hits. Low job-finding rates during recessions imply that displaced workers will likely face a long period of unemployment and skill destruction, feeding into future labor market outcomes because of the skill dependence of labor market hazards. These effects are exacerbated by the long periods of inactivity experienced by the young during recessions. In a nutshell, the interaction between skill accumulation and the dual labor market plays a role in determining the long-lasting consequences of recessions, particularly for young workers entering the economy when the recession starts.

The stochastic model economy features two aggregate states (Z) affecting the labor market: Boom (B) and Recession (R). We assume that a Markov process governs the transition rates between B and R. To assess the Great Recession (GR), we simulate the baseline stochastic model under the history of “observed shocks” during the GR in Spain (Z=R from January 2008 to December 2017). Then, we compare the predicted lifetime outcomes of various cohorts entering the economy during the GR with those that would have resulted in a typical boom or recession (a stochastic economy starting in 2008 with Z=B or R, which persists over time according to the Markov process governing the evolution of the aggregate state Z). In this respect, our approach can go much further in quantifying the scarring effects of labor-market entry in a recession than past empirical studies, which are usually bound to limit their analysis to about a decade after labor-market entry due to data limitations. Moreover, our approach incorporates the effects of inactivity at young ages, which turns out to matter.

We find that the cohort of workers entering the economy in 2008 faces the highest reductions in lifetime earnings. We measure the penalties caused by the GR as the expected loss relative to a typical boom economy. This requires computing expectations over all possible paths that the economy starting at Z=B could have followed after 2008. We find that the GR diminishes expected lifetime earnings by 5.7% for high-school dropouts (DO), 7.3% for workers with completed high school (HS), and 3.4% for college-educated (CO) individuals relative to a typical boom. The reduction in expected lifetime employment is much lower for college-educated individuals (0.7 years) than for the other education groups (1.5 years for DO and 1.75 years for HS). Since skill accumulation is more important for college workers, a year out of work implies a higher penalty on future earnings of college individuals, making their lifetime losses substantial. Comparing across cohorts, earning penalties diminish for younger cohorts because they are less exposed to the GR, but remain sizeable even for the 2014 cohort.

Once the GR is over, what are the scars left on workers (if any)? We assess macroeconomic risks and the scars from recessions by comparing the lifetime earnings of the 2008 cohort under three alternative scenarios on the path of macroeconomic shocks. The first scenario corresponds to the GR: The aggregate state is Z=R from 2008 until January 2017, when the economy enters a typical boom (Z=B). The next two scenarios are counterfactual. In the second scenario, we assume Z=B in January 2017 but without taking a stand on the history of aggregate shocks up to that date. The third scenario corresponds to a Great Boom: The economy experiences a boom from 2008 to 2017 (Z=B up to January 2017). While the distribution of future aggregate states does not vary across the three scenarios considered, we find large differences in expected lifetime earnings after 2017. In 2017 expected lifetime earnings (of the 2008 cohort of high-school graduates) in the GR is 7.8% below the average from all possible histories up to January 2017 (scenario 2). Moreover, earnings from 2017 onwards are 1.5% higher in the Great Boom than under scenario 2. Similar results hold for the other education groups. In sum, macroeconomic shocks early in the career leave permanent and sizeable marks on future labor market outcomes.

To evaluate the role of skills accumulation, we simulate the GR in a version of our model economy in which skills evolve independently of the employment history of individuals. We find that the GR reduces lifetime earnings of the 2008 entrants’ cohort of high-school graduates by 2.5% relative to a typical boom, which is about a third of the penalty found in our baseline economy. The scars from the GR are also much lower: Lifetime earnings from January 2017 are now 1.7% lower than in a typical boom (relative to 7.8% in our baseline economy). Our findings highlight that skill accumulation provides substantial amplification of macroeconomic risks.

Duality is a distinguishing feature of the Spanish labor markets. One implication of duality is that individuals lucky enough to find a permanent job early in their careers may perform much better. We then ask: How much does finding a good job early on in a career matter? Does duality affect the consequences of business cycle fluctuations?

To answer these questions, we evaluate how expected lifetime labor market outcomes in our model economy worsen if workers at permanent jobs switch their labor market status. We clone workers at permanent jobs two years after entering the economy, placing them in another labor-market state (such as temporary work or unemployment) to shut down selection effects into permanency. Differences in lifetime outcomes across labor market states are the highest for the HS group: HS clones with a temporary job in a boom face a lifetime penalty of 3.2 yearly earnings relative to an otherwise identical permanent worker, whereas the penalty is 5.2 among unemployed clones. Recessions amplify the importance of initial labor market conditions. A temporary worker entering the economy at the start of the GR (on average) will work less than 2.5 years (versus 1.5 years when starting in the boom) than an identical permanent worker. The earnings penalty during the GR is (in terms of yearly earnings) 5.24 for clones that become temporary workers, 7.63 for unemployed clones, and 14.1 for inactive clones (relative to 3.2, 5.2, and 12.2 when starting in a boom). Our findings underscore that a bad start in the labor markets diminishes skill accumulation and negatively feeds into future employment and skill growth. Recessions exacerbate these effects.

All in all, macroeconomic risks faced by Spanish workers are large, persistent, and vary across cohorts and demographic groups. The interaction between skill accumulation and the dual labor market is crucial for understanding the effects of macroeconomic risks on lifetime career outcomes.

Further Reading:

Erosa, A., I. Gálvez-Iniesta, and M. Kredler (2023). Being Young in Spain and the Scars from Recessions. Manuscript (uc3m).

About the authors:

Andrés Erosa is a Professor of Economics at Universidad Carlos III de Madrid. His research interests are in Macroeconomics, Entrepreneurship, and Inequality.

https://sites.google.com/view/andres-erosa

Ismael Gálvez-Iniesta is a visiting professor at the Department of Applied Economics at the Universitat de les Illes Balears. He works on Macroeconomics, Immigration, and Labor Economics.

https://sites.google.com/view/ismaelgalvez/

Matthias Kredler is an Associate Professor at the Economics Department of Universidad Carlos III de Madrid. He works on Macroeconomics, Family Economics, and Labor Markets.

https://sites.google.com/view/matthiaskredlershomepage

References:

Bentolila, S., P. Cahuc, J. J. Dolado, and T. Le Barbanchon (2012). Two-Tier Labour Markets in the Great Recession: France versus Spain. The Economic Journal 122 (562), F155–F187.

Costain, J., J.F. Jimeno, and C. Thomas (2010). Employment Fluctuations in a Dual Labor Market. Manuscript Bank of Spain.

Heathcote, J., F. Perri, and G. L. Violante (2020). The Rise of US Earnings Inequality. Does the Cycle Drive the Trend? Review of economic dynamics 37, S181–S204.

Pijoan-Mas, J. and J.-V. Ríos-Rull (2014). Heterogeneity in Expected Longevities. Demography 51 (6), 2075–2102.