Do sentiment shocks have significant aggregate effects on the economy?

By Evi Pappa

Based on research by Andresa Lagerborg, Evi Pappa, Morten O. Ravn.

The horror and heartbreak of mass shootings in American schools, churches, and other public places ripple across the US over the last decade. Media coverage in the aftermath of mass shootings frequently documents expressions of sadness and outrage shared by millions of Americans. In our recent article, Lagerborg et al. (2022), we show that this type of collective emotion can be a powerful force in shaping the US business cycle. In particular, we show that autonomous changes in consumer sentiments have a significant macroeconomic impact and that deteriorating sentiments are recessionary, especially in terms of the impact on the labor market.

An extensive empirical literature in macroeconomics has investigated the sources of impulses to the business cycle. The large majority of papers on this topic have provided causal evidence on the impact of shocks related to economic fundamentals, such as monetary and fiscal policy shocks, and technology or oil price shocks, among others. However, the economy may also be affected by shocks unrelated to economic fundamentals, the so-called ‘animal spirits,’ but there is very little – if any – direct evidence of the impact of such shocks on the aggregate economy.

The central challenge to estimating the causal effects of shocks that are unrelated to fundamentals is the translation of such shocks into functions of observables. We address this issue by extracting an autonomous component from consumer confidence data based on survey evidence on U.S. household expectations about the future outlook for the U.S. economy. The idea is that such consumer confidence data may reflect both households’ views on the economy’s future path based on their knowledge about economic fundamentals and an autonomous component unrelated to fundamentals, ‘consumer sentiments’. We extract this latter component by means of an instrumental variables (IV) approach. In particular, we adopt an instrument that reflects news about events that are arguably unrelated to economic fundamentals, but which impact consumer confidence. This allows us to identify the consumer sentiment shocks and estimate their causal effects.

As an instrument for sentiment shocks, we use the number of fatalities in mass shootings in the U.S. The idea of the instrument is that these tragic events, while not having any direct macroeconomic costs, may impact consumer sentiments through the general populations’ psychological well-being and via this channel affect the broader economy. The validity of the instrument hinges on the survey respondents being aware of mass shootings. Supporting this, mass shootings receive considerable press coverage and therefore constitute a source of bad news to a broad cross-section of the U.S. population. It is well-established in the literature that mass shootings can impact psychological well-being despite individuals not directly being under threat themselves, see e.g., Hughes et al. (2011), or Soni and Tekin (2020). The idea pursued is that such psychological effects show up in survey evidence on consumer confidence and thereby allow to identify the sentiment shocks.

The analysis focuses on mass shootings with seven or more fatalities that occurred in a public space and were unrelated to gang crime and commonplace circumstances (e.g., armed robbery, criminal competition, insurance fraud, argument, or romantic triangle). The reason for considering severe mass shootings is to increase the likelihood that the bad news from such events has reached a broad cross-section of the U.S. population.

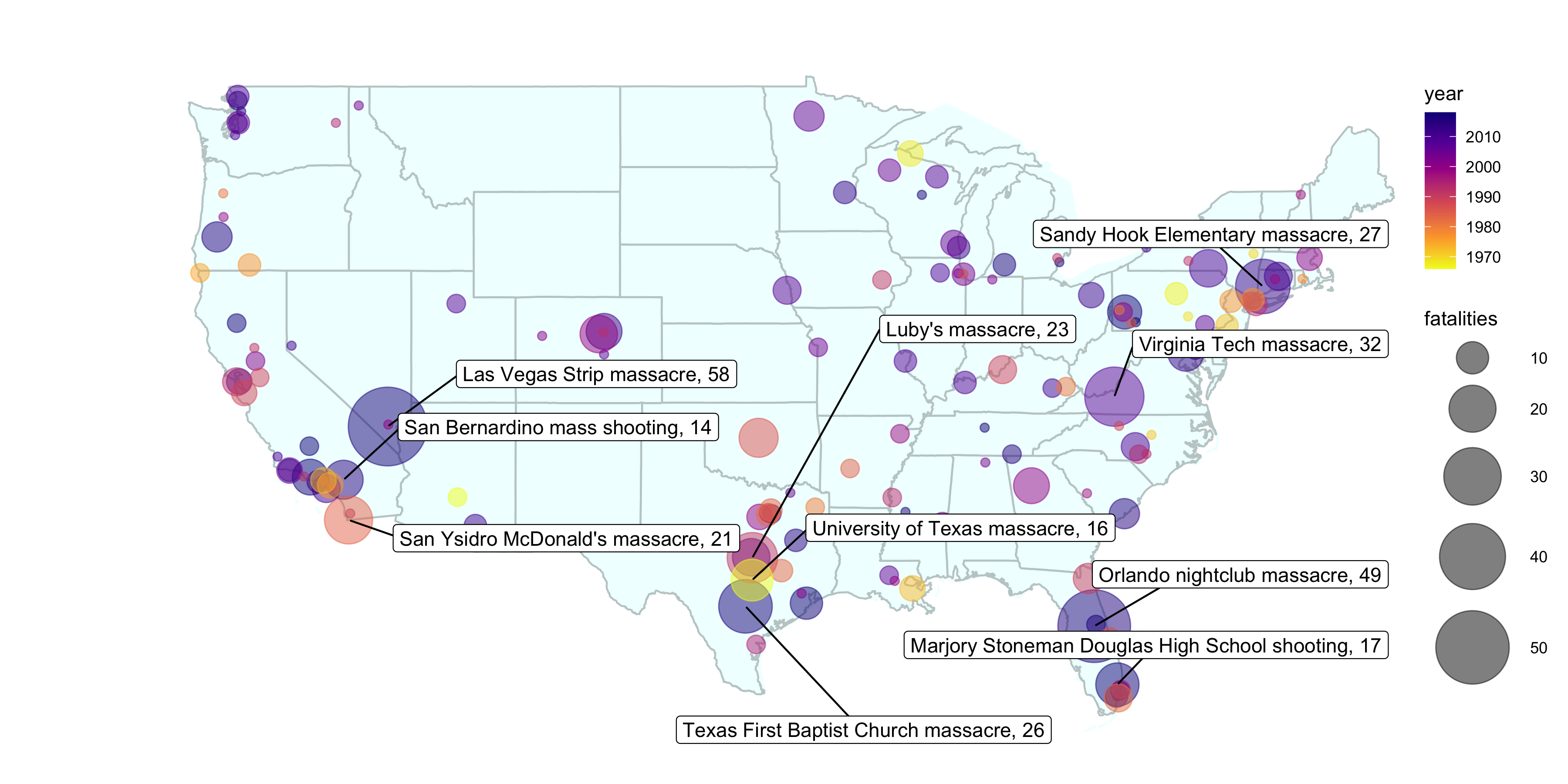

We provide a new database on mass shootings, which builds on the basis of information gathered from three existing sources: Duwe (2007), MotherJones (2020), and The-Violence-Project (2019). The database covers the sample period from January 1965 to November 2018. Figure 1 shows the locations of the shootings on a map of the U.S., along with the number of fatalities (depicted by the size of each circle) and their timeline (depicted by the color scheme). We have also singled out some of the most lethal events. The map illustrates the geographical dispersion of the incidents, although it is also clear that some states, such as California, Florida, and Texas, have witnessed many more events than other states. Secondly, there are many events with a large number of fatalities. From January 1965 to November 2018, there were no less than 42 mass shooting events with seven or more fatalities with a total of 581 fatalities corresponding to an average of approximately 14 fatalities per incident. Perhaps the two most notorious incidents are Columbine High in April 1999, where 12 students and one teacher were murdered, and the Virginia Tech Massacre in 2007, when an undergraduate student murdered 32 people on campus. The single worst mass shooting is the 2017 Las Vegas Strip Massacre in which 58 people were killed and 546 people were injured, followed by the Orlando Nightclub Massacre in June 2016 when 49 people lost their lives and 53 were seriously injured. Notably, the frequency and severity in terms of victims have both increased over time; almost a fifth of mass shootings (that resulted in over 30 percent of total fatalities) occurred in the last three years of the sample.

Figure 1 – Map of Mass Shootings and Fatalities

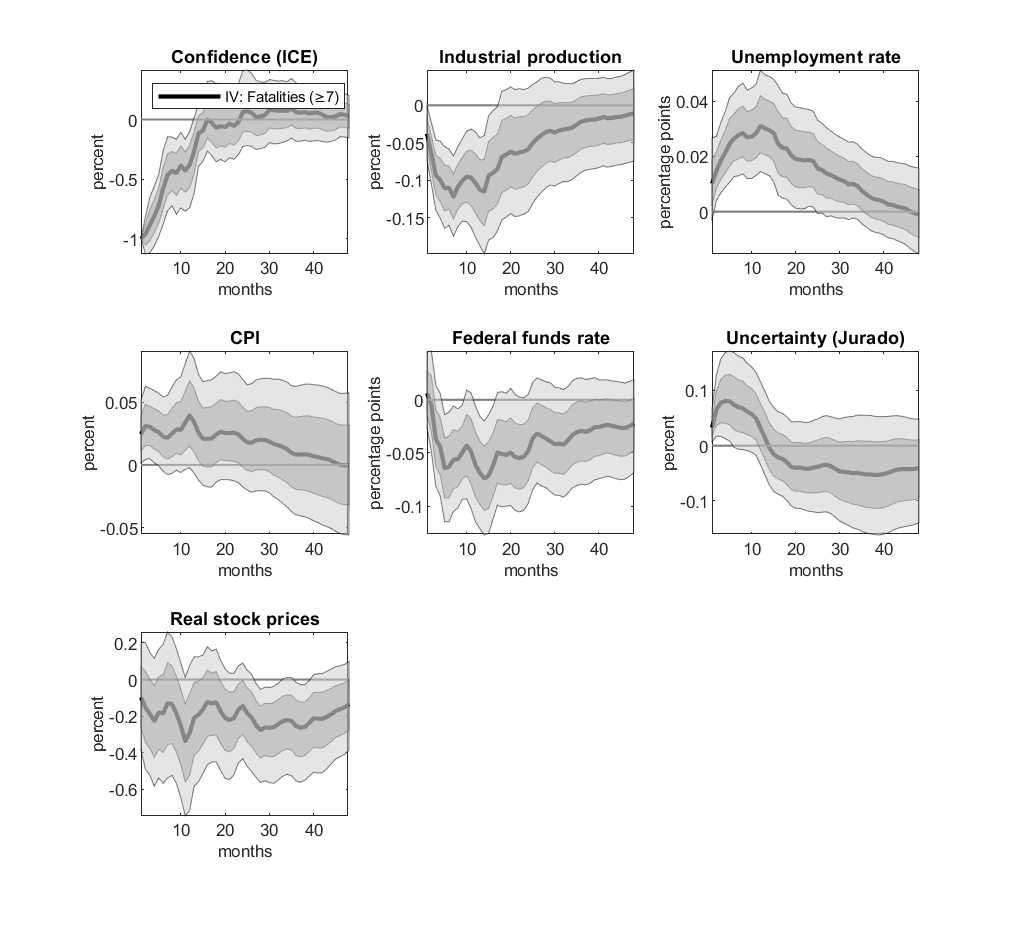

The number of fatalities in mass shootings is a significant instrument for the index of consumer expectations (ICE). We thus use it in the econometric analysis in order to identify the autonomous change in consumers’ sentiments, the sentiment shock. Figure 2 plots impulse response functions to the identified sentiment shock. The continuous line depicts point estimates of the impact of the identified sentiment shock while dark grey and light grey areas represent 68 and 90 percent confidence bands based on the Montiel-Olea et al (2021) weak IV robust standard errors. The sample period is January 1965 to August 1-2007.

According to Figure 2, after a negative sentiment shock, consumer confidence declines on impact, persistently, and significantly so, for around 12-15 months.

Figure 2 – Consumer Sentiment Shock Impulse Responses

Importantly, we find that autonomous changes in consumer confidence affect the wider economy. Deteriorating consumer confidence has a recessionary impact reflected in declining aggregate activity as measured by industrial production. The decline in consumer confidence is also accompanied by worsening labor market outcomes as shown by a rise in the civilian unemployment rate, which remains significantly elevated for around two years, and by reductions in labor market tightness and firms’ vacancy postings (not shown in the graph). We also find that a fall in consumer confidence induces a reduction in private sector consumption of both non-durable and durable goods (not shown in the graph). The shock does not seem to affect significantly the consumer price index (CPI) or the federal funds rate (if anything the graph indicates a slight leaning against the wind). Furthermore, stock prices drop (but mostly insignificantly) after the shock, while total factor productivity (TFP) does not react significantly to the shock in sentiments at any time horizon. Macroeconomic uncertainty rises on impact when measured by Jurado et al’s (2015) index, while no impact is found on other indicators such as the VIX and economic policy uncertainty measures (not shown in the graph). We also perform an extensive robustness analysis to establish the relevance of sentiment shocks in propagating business cycles.

Providing further support for the instrument, we present evidence that the significant effects of mass shootings on sentiments identified at the national level are confirmed using individual-level data. Consumer expectations are shown to drop for individuals residing in the county where the mass shooting takes place, relative to individuals living in other counties, controlling for both time and individual fixed effects.

In sum, autonomous changes in consumer sentiments have macroeconomic impact and it is imperative to design a stabilization policy to insulate the economy from such non-fundamental sources of aggregate fluctuations.

References:

Hughes, M., Brymer, M., Chiu, W., Fairbank, J., Jones, R., Pynoos, R., Rothwell, V., Steinberg, A. and Kessler, R. (2011). Posttraumatic Stress Among Students After the Shootings at Virginia Tech. Psychological Trauma: Theory, Research, Practice, and Policy, 3, 403–411.

Soni, A. and Tekin, E. (2020). How Do Mass Shootings Affect Community Wellbeing.

Manuscript 28122, NBER.

About the authors:

Andresa Lagerborg is an Economist at the International Monetary Fund. She is an applied macroeconomists with an interest on business cycle analysis, gender economics and fiscal policy.

Morten Ravn is a full professor at University College London. He is a macroeconomist working on applied macroeconomics, macroeconometrics, and macroeconomic theory. He is a CEPR Research Fellow, Co-Editor of Quantitative Economics and serves at the Board Member of the Danish National Research Foundation.

https://sites.google.com/view/mortenoravn/home

Evi Pappa is a Full Professor of Macroeconomics at Universidad Carlos III de Madrid. She is a quantitative macroeconomist and her main research interests are related to Fiscal Policy, Monetary Economics, Open Economy Macroeconomics and Business Cycle Analysis. She is a Research Affiliate of the Center for Economic Policy Research (CEPR) and a member of the Euro Area Business Cycle Dating Committee.

https://sites.google.com/site/evipappapersonalhomepage/home

Further Reading:

Lagerborg A., Pappa E. and M.O. Ravn, “Sentimental Business Cycles,” Review of Economic Studies, Review of Economic Studies (2022), forthcoming, doi:10.1093/restud/rdaa002

http://www.restud.com/wp-content/uploads/2022/07/MS29948manuscript.pdf